Pricing Property for Sale:

Pricing is based on 4 fundamental economic principles that guide buyer's purchasing decisions:

- Buyers always face tradeoffs.

- The "cost" of something is what a buyer is willing to give up to buy your home.

- Buyers "think" about marginal of values.

- Buyers respond to incentives.

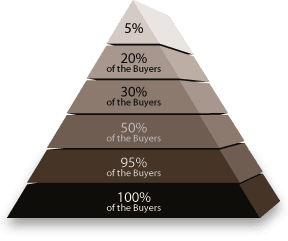

If the Asking Price Is:

- 5% Below Market Value

- 25% Over Market Value

- 15% Over Market Value

- 10% Over Market Value

- 5% Over Market Value

- Fair Market Value

The Property Appeals to:

- The Seller Sets Their Property's Listed Price (Asking Price).

- The Buyer Decides what Cost They Will Pay (Sales Price).

Pricing your home 5% under fair market value maximizes competition and competition maximizes sales prices.

Dangers of Overpricing:

There are only 3 ways market values can move (down, flat, and up). The graphs below illustrate 3 different situations sellers can be in when overpricing their homes. Overpricing is not a good strategy for attaining maximum values. Competition drives the highest returns.

Declining Markets

Overpricing a property in a declining market can produce prolonged drops in value over time. In this situation, the marketplace drift slowly erodes your property's value. This can result in long marketing periods where the value of your property diminishes as you chase the market downward. The only way to counteract over-pricing a property in a declining market is to make price reductions that place the value of your home below the other comparable listed homes in the marketplace.

Flat Markets

Overpricing your home in a flat real estate market can produce prolonged periods where your home sits unsold. In this situation, buyers become indifferent to your listing as they seek homes that have better relative value. In this situation price reductions become more effective than in a declining market. Yet, price reductions must still be large enough to compel buyers to write offers. Thus, reductions must be made below fair market value to counteract the negative interpretations that longer marketing periods create.

Rising Markets

Overpricing your home in a rising market can produce prolonged marketing periods where your home sits unsold. This is not an effective strategy for 2 reasons. First, although higher values may be achieved as the market rises, there is no way to tell if this possible rise in values will occur. Instead, the market may flatten or decline. Second, prolonged marketing periods create a negative story surrounding unsold homes. Buyers ask themselves why has this home has gone unsold. This often means your home will sell below fair market value.

Why Overpricing Is Not a Good Strategy

- Levels Many potential buyers won’t visit an overpriced home, thinking it is out of their price range.

- Those buyers who do look are comparison-shopping, and an overpriced home may convince them to make a bid on a different property.

- It is better to underprice slightly to attract multiple buyers and generate a competitive bidding process. Competition incites the highest prices as you capture the most buyer interest possible.

- Overpricing tends to dampen other agents’ enthusiasm, making it less likely to be shown.

- Properties left on the market for extended periods of time usually become “shopworn”, causing many to believe something’s amiss.

- Overpricing lengthens marketing time. This produces unnecessary market risk for sellers and invariably results in a lower selling price than would otherwise be realized.